Intro

eCommerce has come a long way in recent years, revolutionizing entire industries, like retail or education, and helping

others come to life, like SaaS and online entertainment.

In 1995, Amazon was one of the first companies to envision a market model where goods and services were exchanged online for instant payment, and today eCommerce is one of the most sought-after business models anywhere in the world. Now, in 2020, socially distanced new norms have further enhanced its appeal, and it seems like everyone is trying, in one way or another, to sell online.

In today's eCommerce scene, the ability to accept payments online is among a merchant's top priorities. Regardless of how appealing their offering is or how unbeatable their prices are, nothing prematurely terminates a sale like the lack of an online payment process flow in place.

Beyond marketing approaches, product development, and sales cycles, merchants all over the eCommerce spectrum share an active interest in their goal to accept cards online. Payment processing and its capabilities are what all online sellers are seeking, yet the complexities of this field still have merchants asking "How does an online transaction work" ?

Though there are a lot of concepts to understand and many of the players in the market are confusing - payment gateways, PSP s, merchant accounts, payment service providers, which one do you need? - the online payment process is a logical flow you can easily master.

If you've been looking for online payment basics, you've reached the right place.

What Does Payment Processing Mean?

Online payment processing refers to the exchange of money online as payment for goods or services ordered over the internet. In other words, payment processing is an electronic transaction between a business that is selling a good or service online and a buyer who wants that offering. This process implies the exchange of the buyer's personal and financial information, in order to authenticate the shopper and authorize the transaction.

To be able to accept payments online, a merchant needs to work with one or more middle partners, who provide the technological side of the transaction and connect to the shopper's financial institution to clear the payment. This is usually handled by the merchant's payment processor.

Payment processors allow merchants to accept payments online and manage the entire transaction process. They link to the shopper's bank (also known as the

acquiring bank ) and check the transaction to see if it is suitable for approval. In the process, payment processors also verify the identity of the shopper (to ensure they are who they say they are) and they use anti-fraud mechanisms to avoid any foul play. Payment processors must abide by specific regulations set out by credit card associations, which we will explain further ahead.

Payment gateways are the piece of the flow that collect the shopper's payment information and passes it on to the payment processor. In essence, a

gateway is the front-facing side of the process, while the payment processor facilitates the transaction with the back. A merchant can work with a gateway and processor from the same provider or use separate providers and integrate the flow.

The term

merchant is used to refer to the company that sells goods or services over the internet, sometimes also referred to as

eCommerce merchant. To be able to accept payments online, a merchant opens a merchant account with an acquiring bank. This merchant account is a prerequisite for payment processing, as without it a business cannot collect payments. In effect, the merchant account identifies the seller to the bank which receives the process request, as the recipient of the incoming funds. Both the acquiring bank and the merchant opening an account need to agree to the regulations imposed by credit card associations, like Visa and MasterCard.

The term shopper refers to the person or business who purchases goods or services from a merchant's store. In eCommerce, this happens by having the client input their payment information on a secure page on the merchant's website. This information is then taken on by the payment processor or the payment gateway who will be in charge of authorizing the transaction and communicating an approval or decline of the payment.

How Do You Choose a Payment Gateway?

REPER

If you're looking to accept credit cards online instantly, you'll have to work with a payment gateway to be able to receive payments in your merchant account.

The main criteria to use when evaluating payment gateway alternatives include the following features:

First, you need to evaluate the

payment methods included. Check to see if the major card networks and the most popular

eWallets are supported, and also request

local payment methods if you're planning to target specific geographies.

Second, review the

security features your potential new gateway offers and whether they are

PCI-DSS -compliant. Ideally, you should be working with a supplier who actively uses fraud prevention tools, both automated detection and manual review.

Thirdly, understand the gateway's automatic billing features, if you're considering or are already selling subscriptions. Automated tools are a must when managing subscriptions, to streamline your users' payments and to boost your retention strategy.

Next, see what integration alternatives your store has with the payment gateway. Depending on the solution you're considering, you could opt for self-hosted gateways, hosted gateways, API-hosted, or local bank integration. The choice of one alternative or the other usually depends on your website's technology and on the dev work you have available.

Last, but not least, consider cost efficiency. Evaluate the transaction fee proposed by the gateway and see how it stacks up against the features you are getting. The more complex needs your business has, the higher this fee will be.

To best assess a potential collaborator, there are three main aspects you should

confirm with your future payment provider.

- From a business perspective, ask them to clarify what business model they are recommending and to give you details on the needed merchant account(s). Inquire also about their scalability potential. On one hand, you want to make sure they have the local payment capabilities to support your entry into a new country down the line (think Russia, Brazil, China, or any of the fast-growing markets which call for a local approach). On the other hand, you also want to get a feel of the size of their setup, and whether future scaling plans of your company will be handled directly by them or through partners. Lastly, have them explain their onboarding process and assure its ease. Pay attention to whether you're just getting a gateway, in which case the whole onboarding process will be lengthened by having to find an acquirer as well.

- From a capability perspective, where should you even start? A lot of these needs will depend greatly on what your business is after in the online payment process flow. Start by asking for details about the provider's commerce, marketing, and merchandising options and check available integration and customization options. Also check how they can support you in your goals to increase your conversion rates and get insights from the data moving in your store (think chargebacks, authorization rates, refunds). If selling subscriptions, don't forget to check their subscription billing options and clarify from the start how the payment processor - billing provider connection works.

- Financially, try to clarify all fees and operational costs from the start. Some fees, like the ones for API calls, chargebacks, or refunds, may not be so visible in the terms now, but you will definitely run into them down the line. Ask about additional integration costs as well as available support resources.

Benefits of Accepting Payments Online

Merchants are interested in how online payments work because the process itself can bring a lot of advantages that generate profit. Depending on how the setup is made, merchants address a lot of their business needs with the help of the payment processor.

For one, the payment provider helps the eCommerce business increase its sales. This is possible by helping the shop expand to more countries, but also through the use of the marketing tools that professional providers bring to the table. Capabilities for marketing campaigns (upsells, promotional sales, and cart abandonment campaigns) or new channel distribution (partners and affiliates) can substantially round up a merchant's revenue stream. There are also subscription capabilities, which can bring in recurring revenue flows.

Another benefit to consider is how much of the complexity of security and compliance needed in the process a provider will offload from the merchant. There are a lot of risks when handling online payment processing, but a professional platform can help you stay compliant, maintain airtight security for your shoppers' sensitive data, and clear your transactions faster.

WHITEPAPER

See how easy it is to go global and other benefits of going beyond payments, by downloading this Free Whitepaper!

Are online payments safe?

With all the benefits that come from online payment processing, some challenges that merchants need to overcome may also arise. A lot of these can be outsourced to your payment provider, if they have the capabilities available.

The risk of fraud is probably the first that comes to mind. As online fraud rates have increased in recent years, the whole premise of an online payment process is to provide the merchant the ability to operate the transaction in a secure environment.

Experienced payment providers can equip merchant's stores with fraud prevention tools such as address verification systems, tokenization dynamic 3DS, and AI-powered and manual review processes, tools which considerably decrease fraud risks if used in combination. In addition, professional payment processors streamline the security compliance process, as they are usually PCI-DSS certified.

Technical challenges are also something to expect, and the payment processor's role is key here, starting with the payment integration in the merchant's shop, all the way to accepting more modern means of payment, like eWallets for example. When working with a professional provider your customization options will be much richer and you may even benefit from customizable APIs. The payment processor can even support you with handling disputed transactions that turn into chargebacks.

Your goal when dealing with chargebacks is to maintain a good position with credit card companies and, as the middle-man, your payment processor can help in this respect. Advanced technical capabilities also allow the payment provider to collect the appropriate taxes you have due from shoppers in certain markets, further ensuring your compliance with regulations.

As 2020 has brought with it many new house-bound online shoppers and eCommerce transaction volume is expected to reach $630 billion in the US, merchants want a share of that slice but also want to stay safe in the process.

Fortunately, as eCommerce has grown in size, relevant authorities have also doubled down on enforced regulations. Today there are several standards and regulations in place to protect merchants and shoppers alike from online payment fraud.

WEBINAR

Watch this session with Una Dillon, Managing Director at Merchant Risk Council, to learn about fraud trends and best practices in combating them.

REPER

The first layer of protection you get is from the payment card security standards. Credit card networks like Mastercard and Visa enforce this set of standards, which comprises 12 general data regulations. To accept credit card payments online, merchants and their payment providers need to be PCI-compliant. On top of PCI compliance, merchants selling in Europe who want to accept card payments must also comply with the PSD2 (Payment Service Directive), which enforces strong verification mechanisms for online payment processes, such as SCA (Strong Customer Authentication).

REPER

Apart from payment regulations, online transactions are also covered by the different data protection laws applied throughout the world. Merchants in Europe need to comply with the

GDPR, while those in California are covered by the

CCPA, both regulations governing how the privacy of consumer data is handled, and directly impacting the payment process.

In terms of the security of specific payment methods, the market has come a long way in recent years.

Credit cards are among the payment means considered safest for online transactions - and it's no wonder they are, as they are covered by so many regulations, including PSD2 in Europe as we mentioned earlier, as well as the Fair Credit Billing Act in the US.

eWallets are also known to offer tight security, as their payment flow doesn't involve sharing the user's bank data with the merchant and their gateway.

Direct debits are another top safe means, chosen widely in Europe especially for recurring sums.

At the end of the list, wire transfers are sometimes associated with fraud risk, as the parties' identities aren't

checked quite as thoroughly as they are for other payment methods.

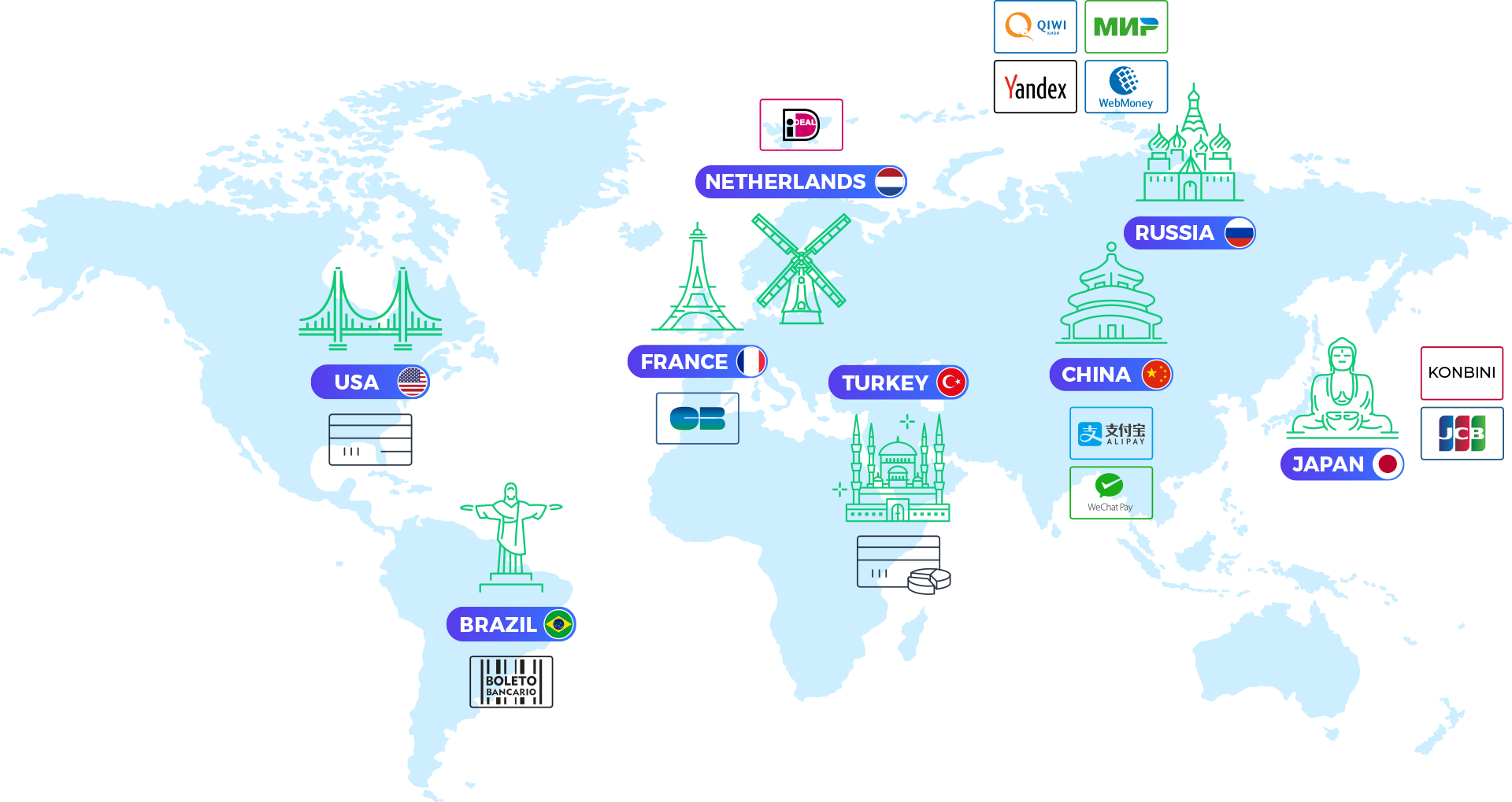

Popular Online Payment Methods Globally

Not having access to their preferred shopping methods is one of shoppers' pet peeves, and they may abandon their carts in hordes if this condition isn't met. As a merchant, you want the shopper's experience to be up to their expectations, so you need to address this preference for a localized cart with the right payment methods.

Some payment options are a must all over the world, given their large usage rate.

Other payment methods show a marked preference only in specific geographies, so you must know your market in order to increase conversion rates there.

EUROPE

- Netherlands: iDEal

- Russia: Qiwi, Yandex, MIR, WebMoney

- France: CarteBleue

- Turkey: Credit cards with installments

THE AMERICAS

- USA: Credit cards

- Brazil: Boleto Bancario

ASIA PACIFIC

- China: AliPay, WeChat

- Japan: Konbini, JCB

SOLUTION BRIEF

Download this Free Solution Brief for a deep dive into the 45+ payment methods and 100 display and billing currencies supported out of the box by 2Checkout!

Have You Considered Mobile Payments?

If your business isn't already taking advantage of mobile payments, you should consider what you are missing.

With five billion mobile users in the world, mobile payments offer a major opportunity for companies to reach new markets, increase sales, and even experiment with new technologies.

One of our most recent surveys shows that, while desktop purchasing remains in the lead, used by 82% of buyers, mobile is becoming a large and growing channel that merchants can't afford to ignore. Mobile is expected to account for nearly half of all retail eCommerce payments by the end of 2020.

It's no wonder that mobile payments have become so beneficial to retailers. They put consumers first, letting shoppers do quick searches on mobile to find what they want and complete their purchase while in a buying mindset.

An impressive 78% of software and SaaS buyers find products by searching online, and many of those searches likely happen on mobile devices, so letting people buy in real-time can really ramp up conversion rates. Mobile payments let users buy what they need anytime, anywhere, right when they're thinking about it.

When creating your mobile strategy, keep in mind that mobile payments don't refer only to mobile wallets like Apple Pay or Google Pay. Mobile payments also include paying with a credit card on the mobile web.

Make sure you offer a good user experience that is simple and straightforward and also doesn't interfere with the ability to get info or make a purchase. Make sure that your mobile site or app loads quickly and always test your mobile purchase flow extensively, with real users, to ensure it presents no technical barriers to purchase.

Online Payment Charges

As you would expect, online payment processing services aren't free, but when you know what to look for, the returns on your dollar are that much greater. In essence, the fees for an online transaction are usually a sum of the costs of all the parts charged by each player.

So, the payment processing fee doesn't just go out to your payment provider, it's split up between the middlemen in the chain.

REPER

The acquiring bank, meaning your merchant account bank, takes a share in the form of a markup fee - after all, it is safeguarding your funds. The issuing bank, meaning the shopper's bank, also collects an interchange fee. This acts as a balancing mechanism in the whole scheme. Credit card associations impose an assessment fee when their means are used, which makes up another part of the online payment cost. Last but not least, your payment processor collects a processing fee to cover the final step that facilitates the transaction.

If you're shopping around for a payment provider and run across several different ways to bundle these costs, know that in effect they will still include the costs listed above. Some providers go for flat-rate payment fee pricing (a transaction-fixed fee), consisting of a percentage of the sale and a dollar amount. In an interchange plus bundle, you'll pay a percentage of the sale plus a dollar amount on top of the interchange fee.

Still, other providers employ tiered fee pricing, where the interchange fees used in the calculation are classified in several categories, which impact the cost:qualified, mid-qualified, or non-qualified. A newer pricing bundle on the market is that of membership pricing, where the merchant pays a flat dollar amount per transaction, but they also pay a monthly subscription with their provider.

Regulations Around Online Payments

Capabilities alone for payment processing aren't enough for eCommerce. Merchants can sell in markets only if they respect national and local regulations, which govern how they can transact. A lot of a merchant's efforts are directed towards compliance, so it is important to know what standards impact your line of business.

To be able to accept online card payments, card networks require that merchants use specific modern tools to check the security of their transactions. Recommendations from Visa and Mastercard state that the merchant needs to properly identify the shopper, use AVS, or monitor their orders. The PCI Security Standards Council is another authority that regulates card payments. To accept cards in their online shops, merchants all over the world need to attain one of the four levels of PCI DSS compliance.

Other standards that help keep eCommerce a safe space include:

Anti Money-laundering programs (to prohibit the moving of illegally obtained funds via online transactions)

Know Your Customer processes (which take the form of Customer Identification Programs used by merchants, banks, and even government agencies)

or Local Regulations for specific payment methods (the PSD2 in Europe for online card payments).

While they ensure the security of payments, merchants also need to pay the tax due in the countries where they are selling.

Fiscal compliance is an important part of online payment regulations, and it comes in many forms. Some states collect a value-added tax, while others collect a sales tax. Differences in percentage here can vary even at the local jurisdiction level. Each state also comes with its own set of rules for what products are taxed, which are exempt, and which benefit from reduced taxation.

In terms of tax compliance, a professional payment provider can offload the merchant's work here in each country they're selling in.

Want to learn more? Find out:

Conclusion

REPER

Now that you understand everything about online payment processing, you have the knowledge you need to take on this business model and scale your reach across the world. You should be familiar with the players in payment processing and how each one is involved in the transaction process. You probably already have some ideas about what type of integration would be suitable and what pricing bundle you'd prefer. You are now knowledgeable about what payment and connected capabilities you need and have probably already started making lists of the payment methods you'll be accepting online.

Succeeding in eCommerce today has a lot to do with staying up-to-date on what options you have and how to maximize these for your business. If you're curious to see how a leading payment platform with full monetization capabilities can upgrade your online sales, take 2Checkout on a test drive with a free account.

2Sell Accept mobile and online payments from buyers worldwide

2Sell Accept mobile and online payments from buyers worldwide

2Subscribe Subscription management solution to maximize recurring revenue

2Subscribe Subscription management solution to maximize recurring revenue

2Monetize Full commerce solution built for digital goods sales

2Monetize Full commerce solution built for digital goods sales

Add-ons Additional services to boost online sales

Add-ons Additional services to boost online sales

Login

Login

Login

Login